PrintableJD.Com – Printable Gail Vaz Oxlade Budget Worksheet – Managing personal finances can be a challenging task for many people, especially those who are not equipped with the right tools and resources. However, with the availability of budgeting worksheets like the Gail Vaz Oxlade Budget Worksheet, the process can be simplified and made more effective.

Gail Vaz Oxlade is a renowned financial expert known for her practical and straightforward approach to money management. Her budget worksheet is designed to help individuals or households create an organized system for tracking their spending habits while also setting financial goals. In this article, we will take a closer look at the printable Gail Vaz Oxlade Budget Worksheet and how it can benefit you in your quest to achieve financial stability.

What Is Gail Vaz Oxlade Budget Worksheet?

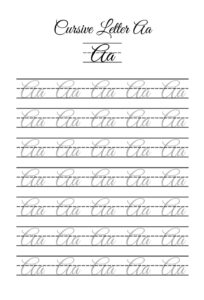

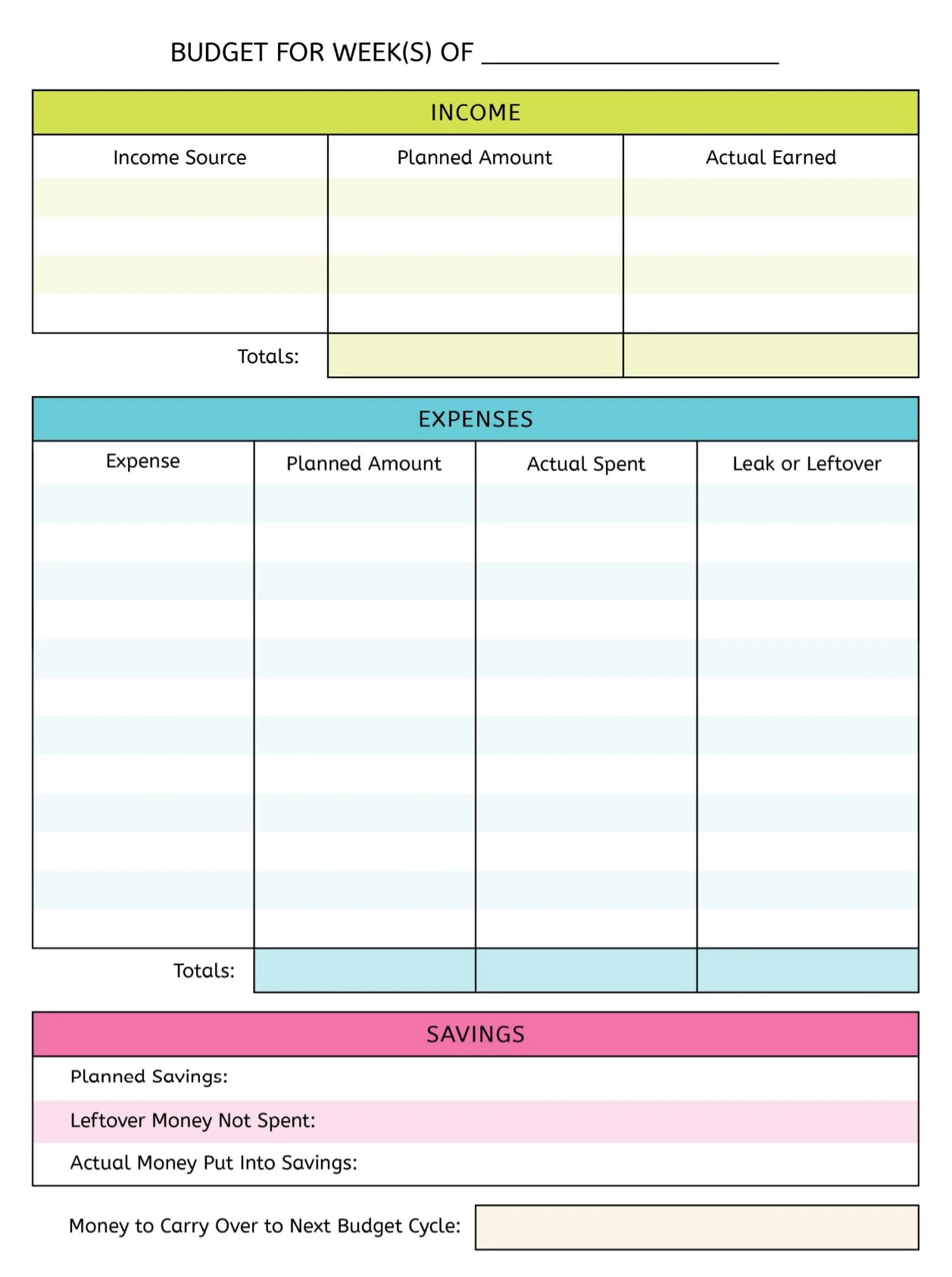

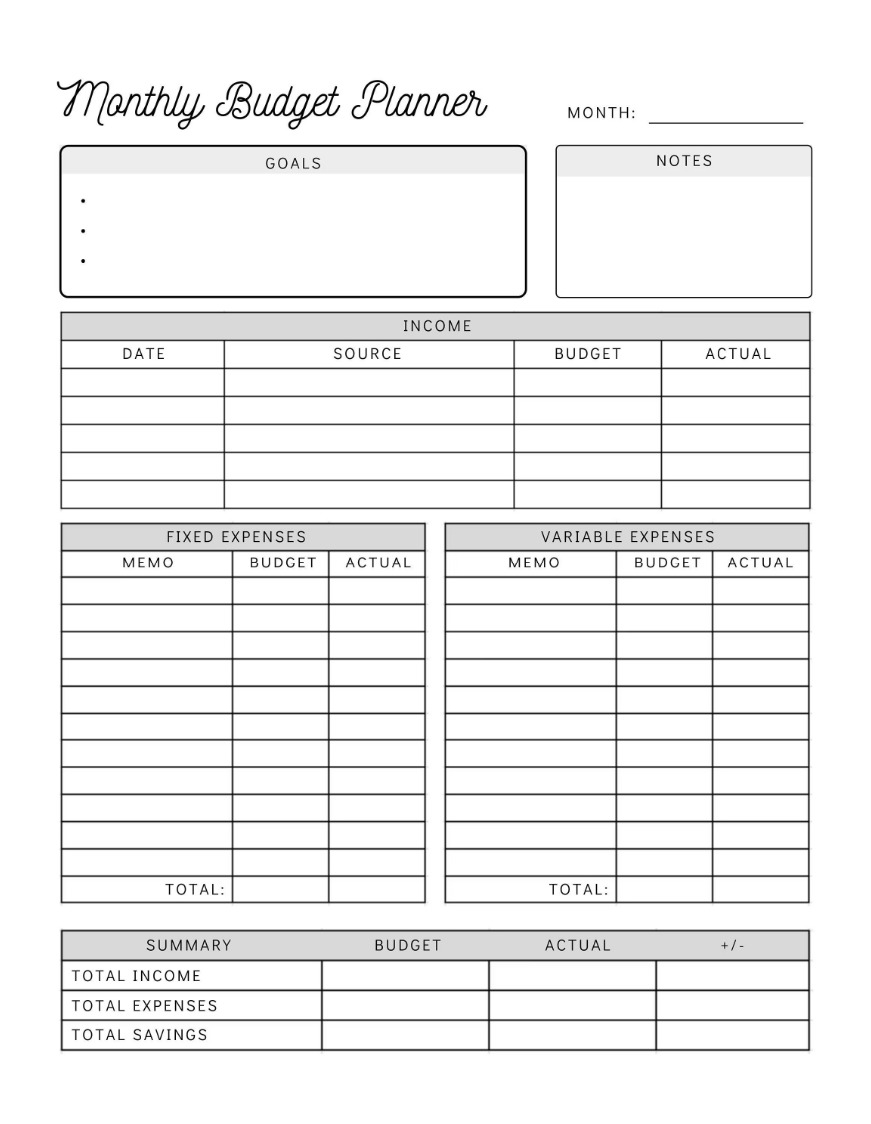

The Gail Vaz Oxlade Budget Worksheet is a printable budgeting tool created by personal finance expert and television personality, Gail Vaz Oxlade. Designed to help individuals and families take control of their finances, this worksheet provides a clear and straightforward way to track income, expenses, savings, and debt.

This budget worksheet is divided into categories such as housing costs, transportation expenses, food and groceries, entertainment costs, etc., making it easy to identify areas where spending can be reduced or eliminated. It also includes sections for tracking debts like credit cards or loans. This worksheet helps users create a realistic monthly budget that aligns with their financial goals.

Overall, the Gail Vaz Oxlade Budget Worksheet is an excellent resource for anyone looking to take control of their finances. Its user-friendly design makes it accessible to people with varying levels of financial literacy while providing valuable guidance on how to manage money effectively. By using this worksheet consistently over time, individuals can develop better habits around saving money while avoiding unnecessary debt.

Where Is Gail Vaz Oxlade?

Gail Vaz Oxlade, a Canadian financial guru, is known for her popular TV show “Til Debt Do Us Part” and her no-nonsense approach to personal finance. However, many people are wondering where she has been lately. In recent years, Gail has taken a step back from the public eye and has not appeared on television as frequently as she used to.

Despite her absence from the limelight, Gail is still active in the financial world. She continues to share her expertise through her website and social media channels and frequently speaks at events and conferences. Additionally, Gail has published several books on personal finance, including “Money Rules” and “Debt-Free Forever,” which continue to be popular resources for those looking to improve their financial situation.

For those who are fans of Gail’s budgeting worksheets, they can still be found online through various sources. These printable worksheets are a helpful tool for tracking expenses and creating a budget that aligns with one’s financial goals. Overall, while Gail may not be as visible as she once was on television, her impact on personal finance education continues to be felt by many individuals seeking guidance in managing their money effectively.

Printable Gail Vaz Oxlade Budget Worksheet

A printable Gail Vaz Oxlade budget worksheet is a great tool for anyone looking to take control of their finances. The worksheet provides a simple and effective way to track income and expenses, create a budget, and monitor progress toward financial goals. With clear instructions and easy-to-use templates, the worksheet makes budgeting accessible to everyone.

One of the key features of the Gail Vaz Oxlade budget worksheet is its flexibility. Users can customize the worksheet to fit their specific needs and financial situation. For example, they can add or remove expense categories as needed, adjust spending limits based on income fluctuations, or set aside savings for long-term goals like retirement or education.

Overall, a printable Gail Vaz Oxlade budget worksheet is an essential tool for anyone looking to improve their financial literacy and build wealth over time. By using this simple yet powerful resource consistently over time, users can gain greater control over their money, reduce debt levels, save more money for emergencies or retirement, and achieve greater financial security in the years ahead.

3333