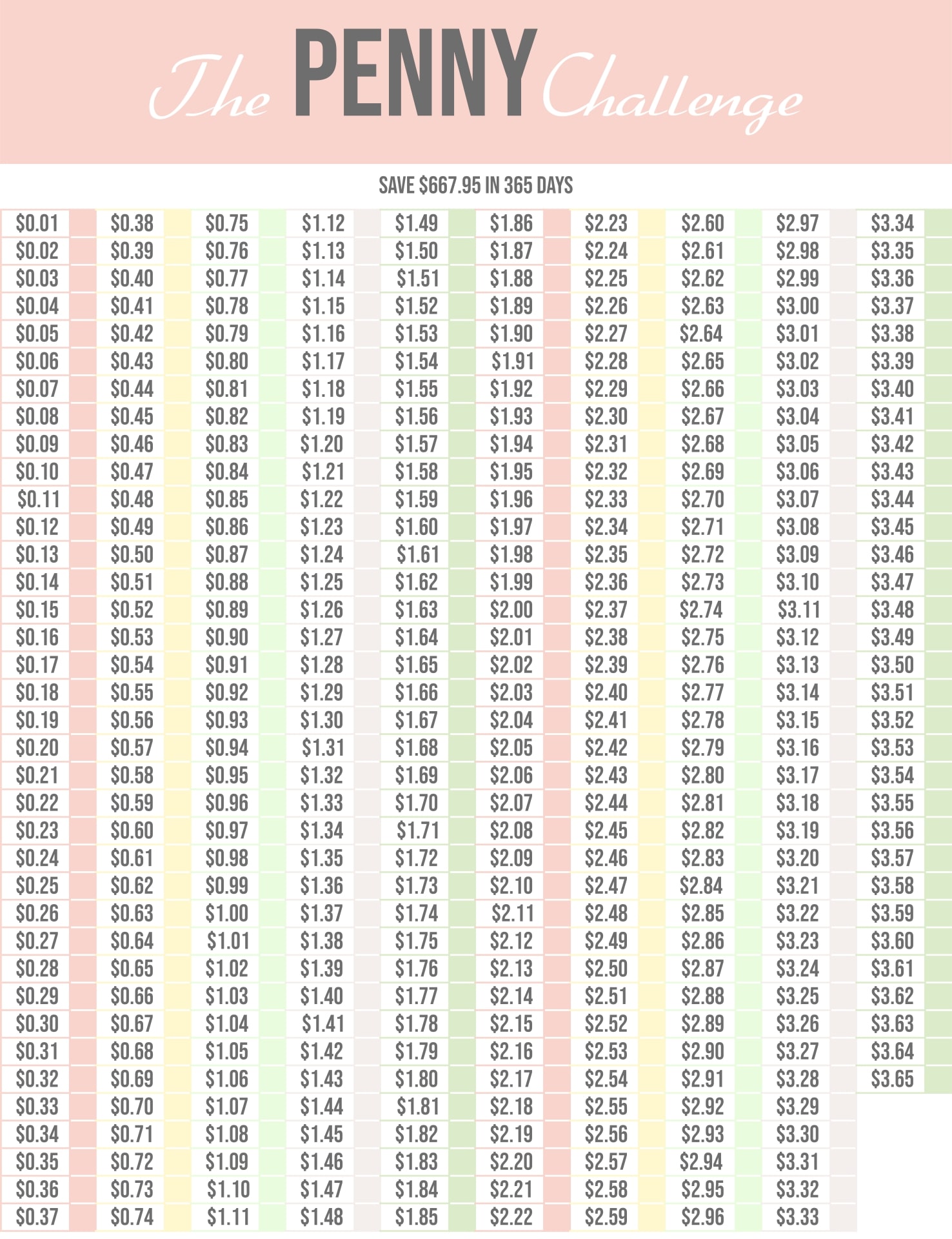

If you are looking for a way to save money each week, then you may want to consider the 52-Week Penny Challenge. If you decide to try the challenge, then you may find that you can easily set up a printable chart that will help you track your progress.

What Is The 52-Week Penny Challenge?

The Printable 52-Week Penny Challenge Chart is a great way to save money. It is easy and simple to start. You can complete the challenge and you will find that it gives you more confidence to save and build your savings.

The goal of the Penny Challenge is to start saving two pennies a day. This can be done in several ways. For example, you can use a paper jar or a jar with coin-counting software. Once you start saving regularly, you can transfer the amount of money you have saved to a high-yield savings account.

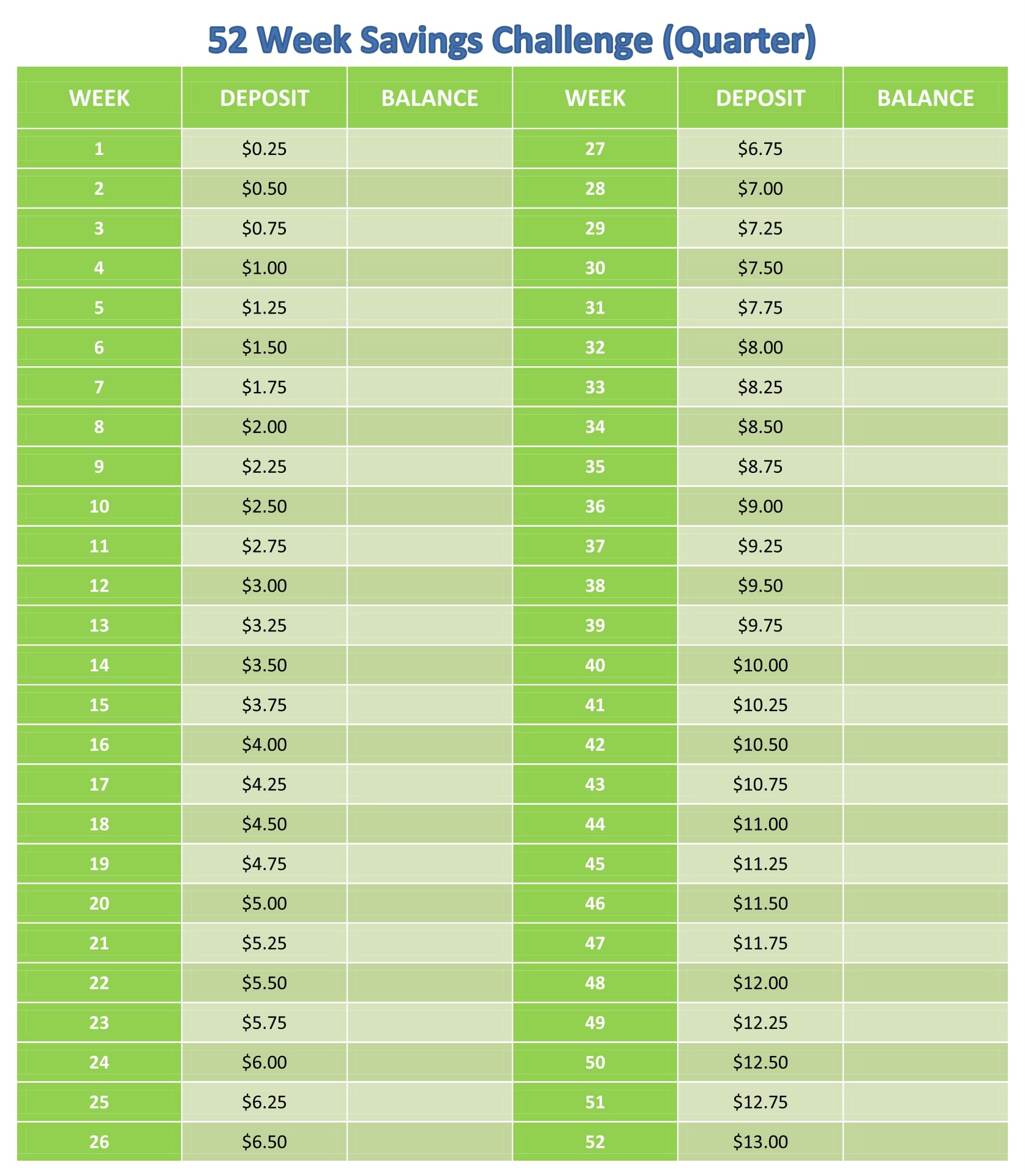

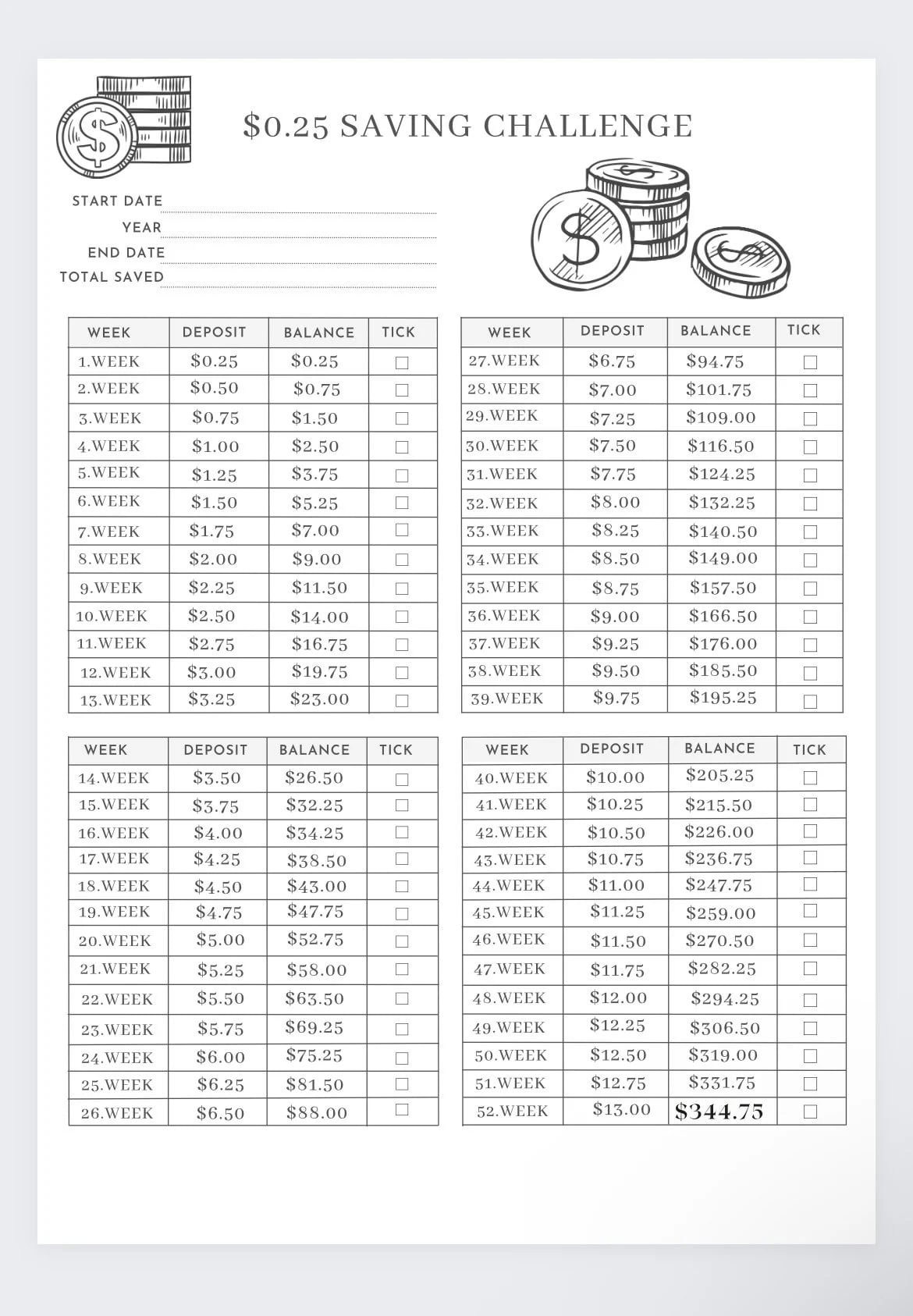

There are five ways you can complete the 52-Week Money Challenge. One way is to write down the amount you save every week in your diary or phone calendar. Another way is to create a chart.

A third way to do the 52-Week Challenge is to do it on an odd-number basis. An example is saving $52 every week, which equals $1,378 by the end of the year.

Lastly, you can do the challenge on a reverse basis. In this case, you will start with higher amounts and move toward lower amounts.

The Penny Challenge is a fun, creative way to get your savings started. Whether you’re looking to pay down debt, travel, or do any number of things, you can do the challenge to help you meet your goals.

How Do You Do The 52-Week Money Savings Challenge?

If you want to start saving money and develop savings habits, the 52-Week Money Saving Challenge is an excellent way to do it. This type of challenge helps you to save more money and gives you the discipline to stick with your plan.

To do the 52-Week Money Saving Challenge, all you need are a few slips of paper and a container for the money you want to deposit. Each week, draw a slip and deposit the amount into your savings account. You can also use this technique to build an emergency fund or to save for a dream vacation.

In addition to the money you have saved each week, make sure to add some interest. It is recommended that you invest in a savings account that pays high interest. Then, at the end of the year, you will have a healthy cash reserve to take care of emergencies.

If you would rather make saving a fun experience, try the random deposit method. Select a different dollar amount for each week. By doing this, you will not be tempted to spend the money you have saved before you begin the challenge.

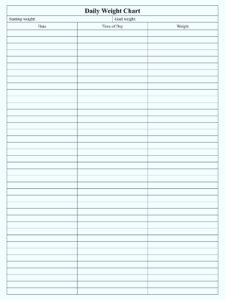

Another option is to create a chart. You can use a calendar or a spreadsheet to keep track of your progress. Just be sure to have an end goal in mind, such as a retirement fund or a down payment on a house.

Printable 52-Week Penny Challenge Chart

The 52-Week Penny Challenge is a great way to learn how to save money. It is a fun way to get used to putting money away, and if you follow the rules, it will end up with you saving a decent amount of money at the end of the year.

In fact, the 52-Week Penny Challenge will even help you to build a nest egg. You’ll end up with over $1,000 saved by the time the year is over.

One of the most important things you can do to improve your finances is to set up bill payment alerts. This will keep you from racking up late payments, which will damage your credit score.

You might want to also set aside a few minutes each day to think about your future and where you would like to be. Consider saving for your retirement, buying a house, or starting a family.

Another good idea is to use a free printable savings chart. A chart can be a handy visual reminder of your weekly plan. As you work toward your financial goals, it’s always a good idea to write down your successes and failures. By doing this, you’ll have a good reference point for your future decisions.

Although there is no hard and fast rule for how much money to save each week, it is helpful to have a general idea. Start small and slowly increase your savings.