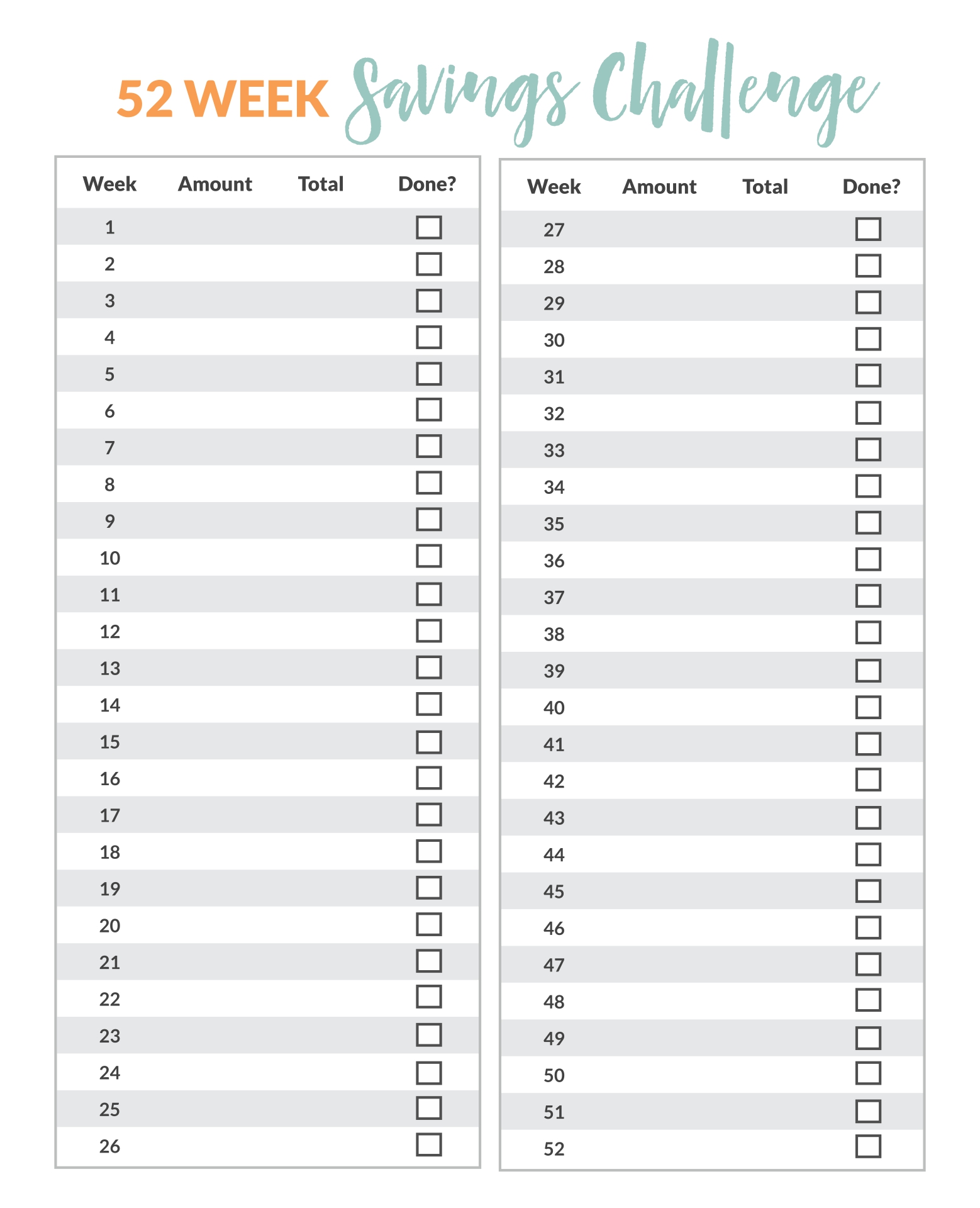

If you are looking for a printable 52 week saving chart, you have come to the right place. This chart will help you determine the amount of money you should have saved during the entire 52 weeks of the year.

How Does The 52-Week Savings Plan Work?

If you’re looking to save money, you may want to look into the 52-Week Savings Plan. The plan can help you save money by increasing the amount you put into your savings account every week. It’s an easy way to get your finances in order.

It’s also a great way to start saving for a vacation or emergency fund. These goals can keep you motivated and make saving easier.

If you’re looking to start a retirement fund, you might want to consider a high-yield savings account. These accounts offer higher interest rates and are separate from your checking account. They also allow you to establish consistent savings habits.

Whether you’re a college student, a freelancer, or someone who needs to save money for a down payment on a house, the 52-Week Savings Plan can be a good way to help you reach your goals. You can personalize the plan to suit your family’s specific needs.

For example, if you are a parent, you might be able to use the plan to teach your children to save. Some people even start with Week 52 at the beginning of the year.

The 52-Week Savings Plan works by setting aside a certain amount of money each week and then accumulating that amount by the end of the year. It’s important to have a plan in place, though, so you don’t accidentally spend all your hard-earned cash.

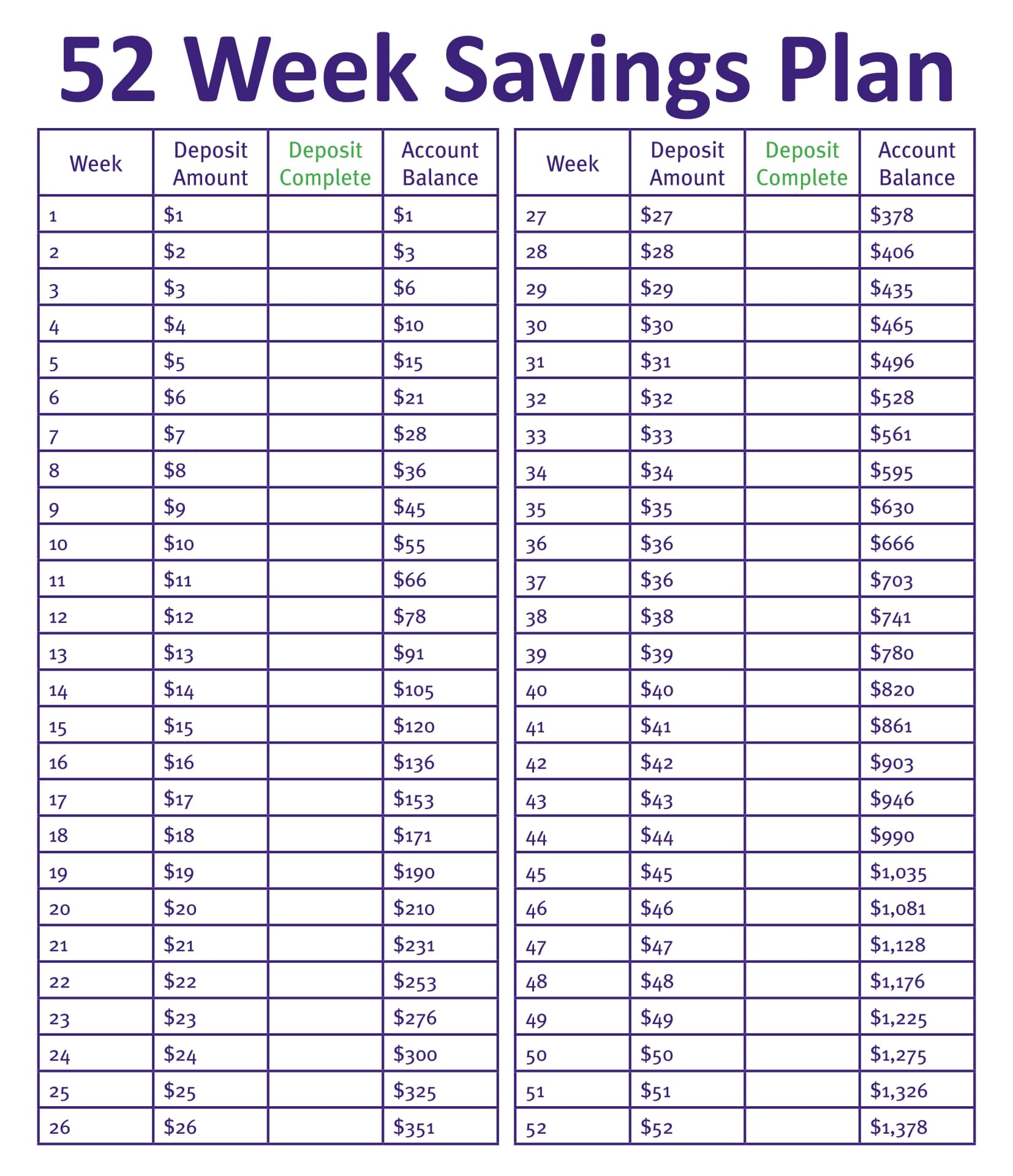

How Much Money Should You Have Saved Over 52 Weeks?

A 52 week money challenge is a great way to learn how to save. It helps you to save more each week and makes it easier to build a savings habit.

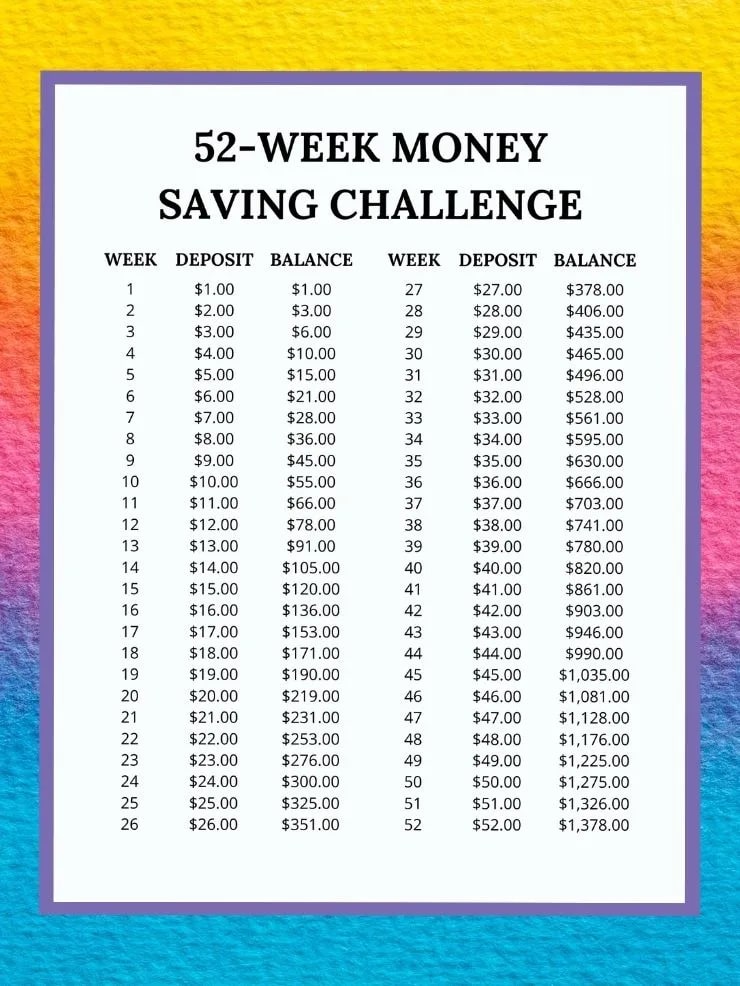

There are two ways you can do a 52 week money challenge. The first is to save $1 per week for 52 weeks. This works well if you have a lot of spare cash, but may be challenging for people who don’t have much disposable income.

Another option is to save a dollar a week for a year. If you’re saving for a major purchase, such as a new car, this could be a good idea. You can double your deposit to help you save faster.

In addition to saving, you should also set aside some money for an emergency fund. The idea is to have at least 3 to 6 months’ worth of living expenses saved in case something goes wrong.

Finally, you should consider a 52-week money challenge as a springboard to other savings goals. For example, you might save more for retirement, college, or even a down payment on a house.

If you’re going to participate in a 52-week money challenge, it’s helpful to have a high-yield savings account. These accounts offer the same insurance and safety features as regular checking accounts, but they can pay a higher rate of interest.

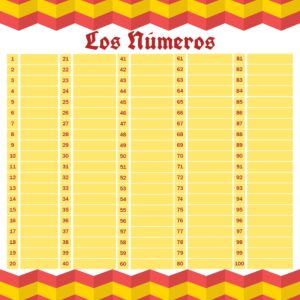

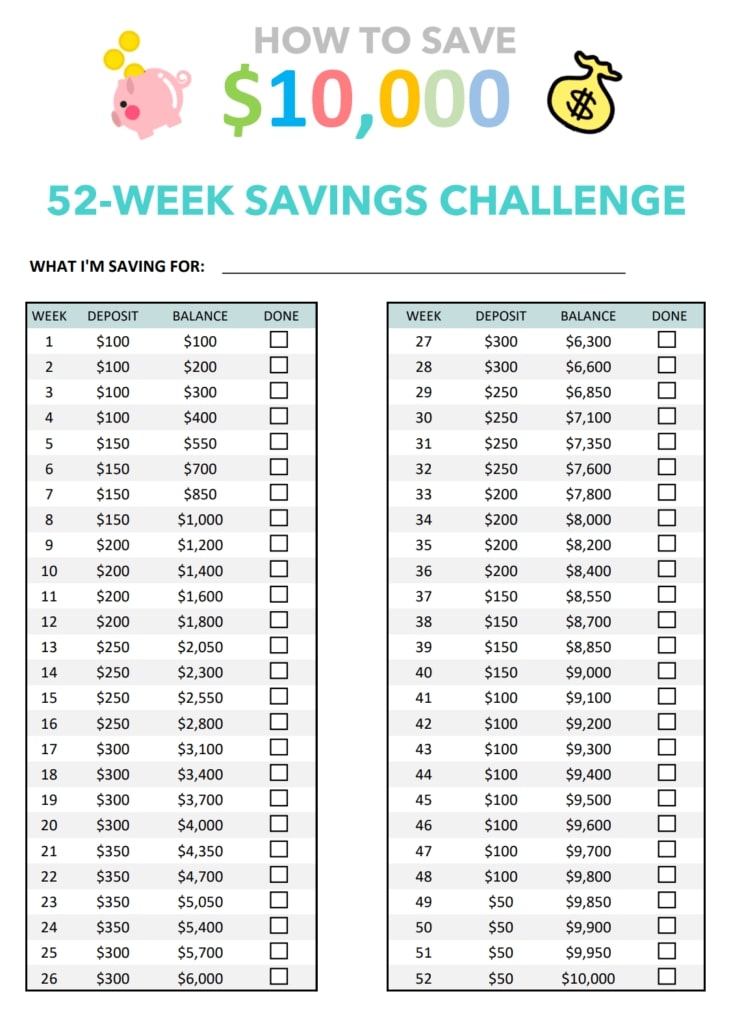

Printable 52-Week Saving Chart

A printable 52 week saving chart is a great way to help you save more money. This type of challenge can be fun and can help you make some serious progress in your financial life. You can also get the benefit of using a chart to motivate yourself to reach a particular goal, whether it be to pay off debt, save for your future, or save for a special occasion.

First, you need to determine the most important part of the chart, the amount you’re going to save each week. For example, if you’re just starting out, you may want to start with the biggest sum you have. Using a spreadsheet is also a good idea. It’s possible to use a program like MS Excel or Google Docs to keep track of your savings.

The chart is also designed to be fun and to get you excited about saving. As a bonus, you’ll see a visual improvement in your finances. If you’re not already doing so, you’ll be able to start a savings plan that fits your budget and lifestyle.

Another way to accomplish the same goal is to use a reverse 52-week challenge. In this challenge, you work through your savings goals, starting with the largest and working down to the smallest.