For the majority of us, pay stubs are a necessary part of our jobs. However, if you’re wondering how you can make your own, read this article. In it, I’ll discuss what you need to know about pay stubs and how you can create your own Printable Blank Paycheck Stubs. You’ll be surprised to learn that it’s easier than you might think.

How Can I Make My Own Pay Stubs?

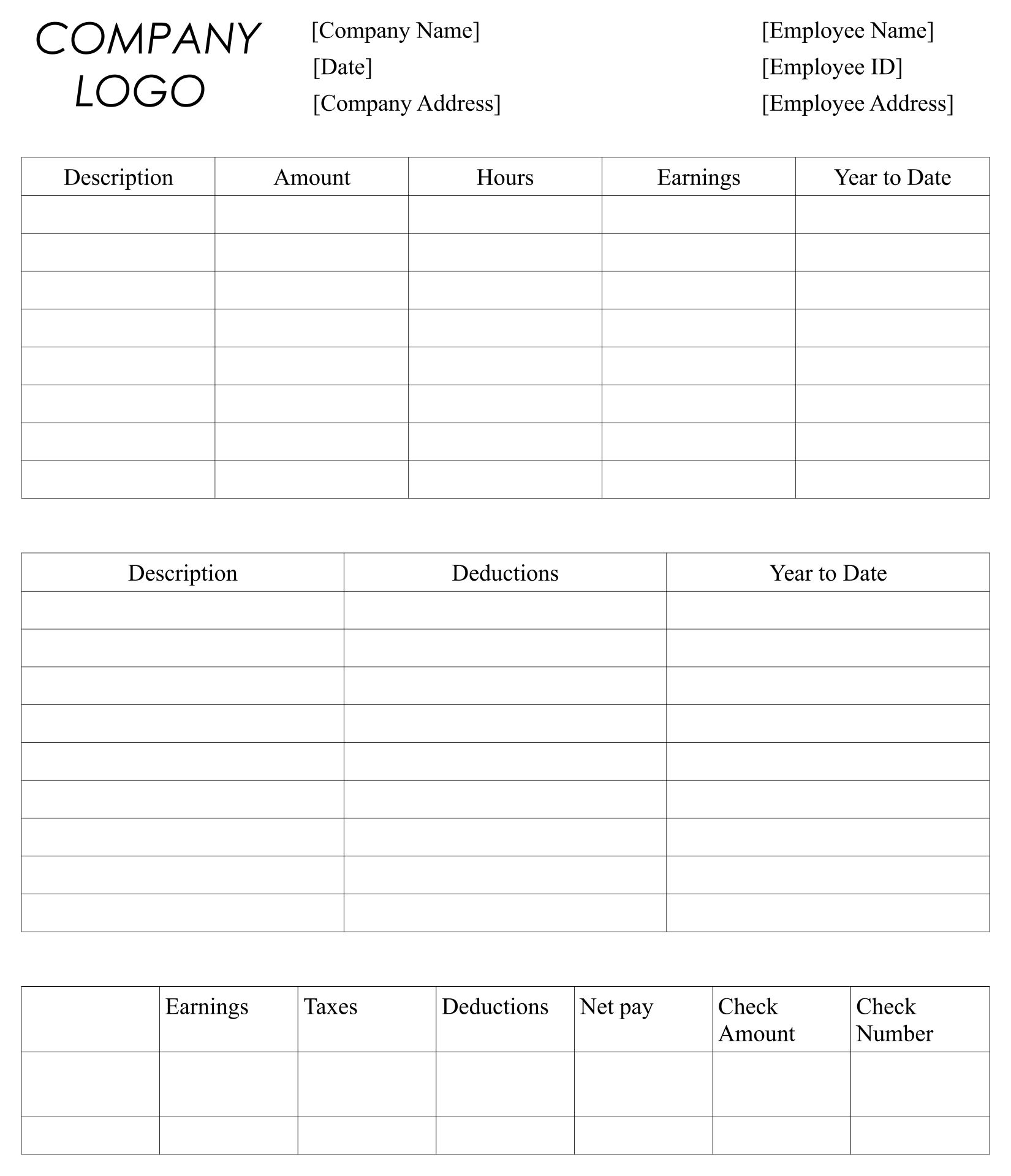

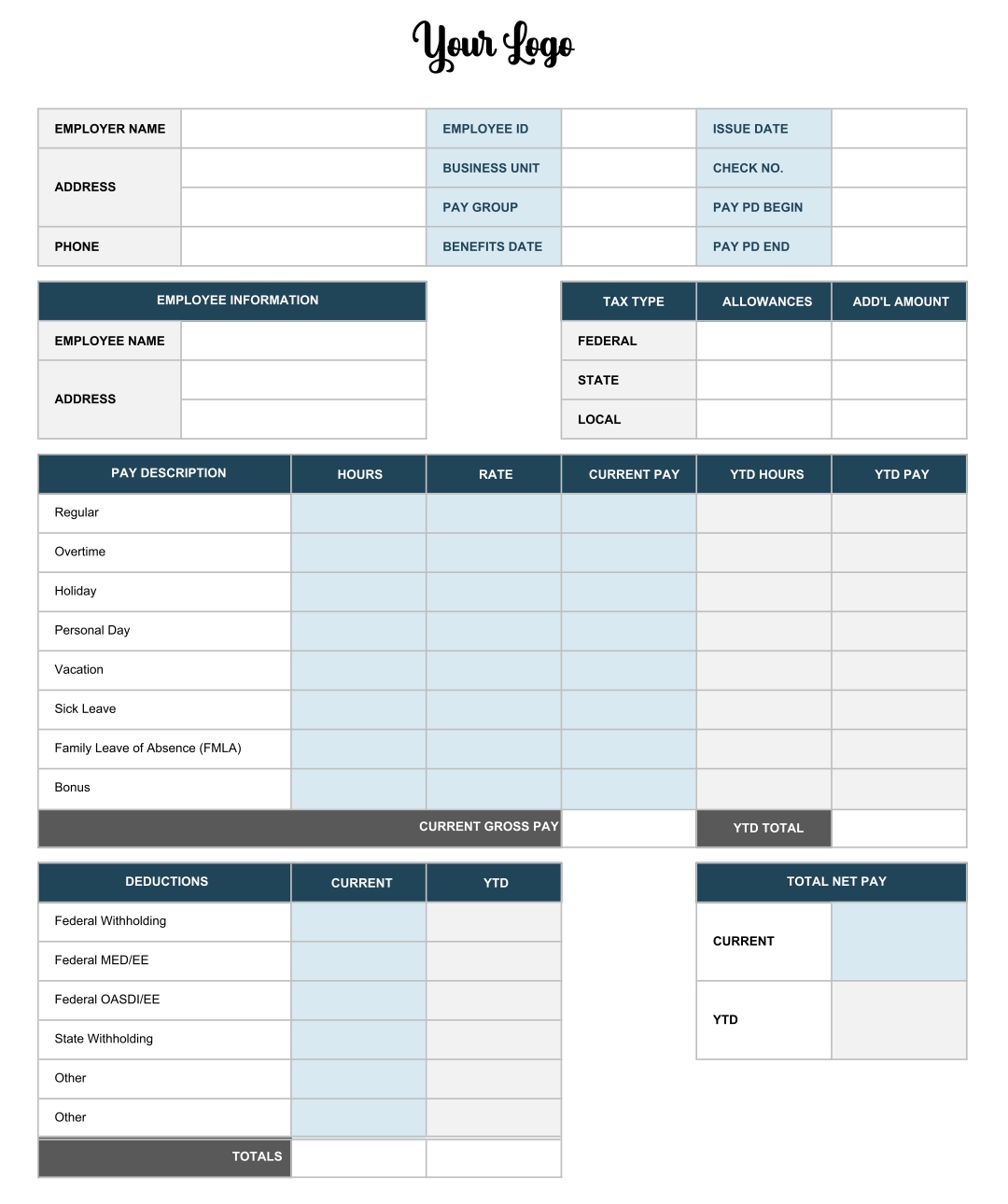

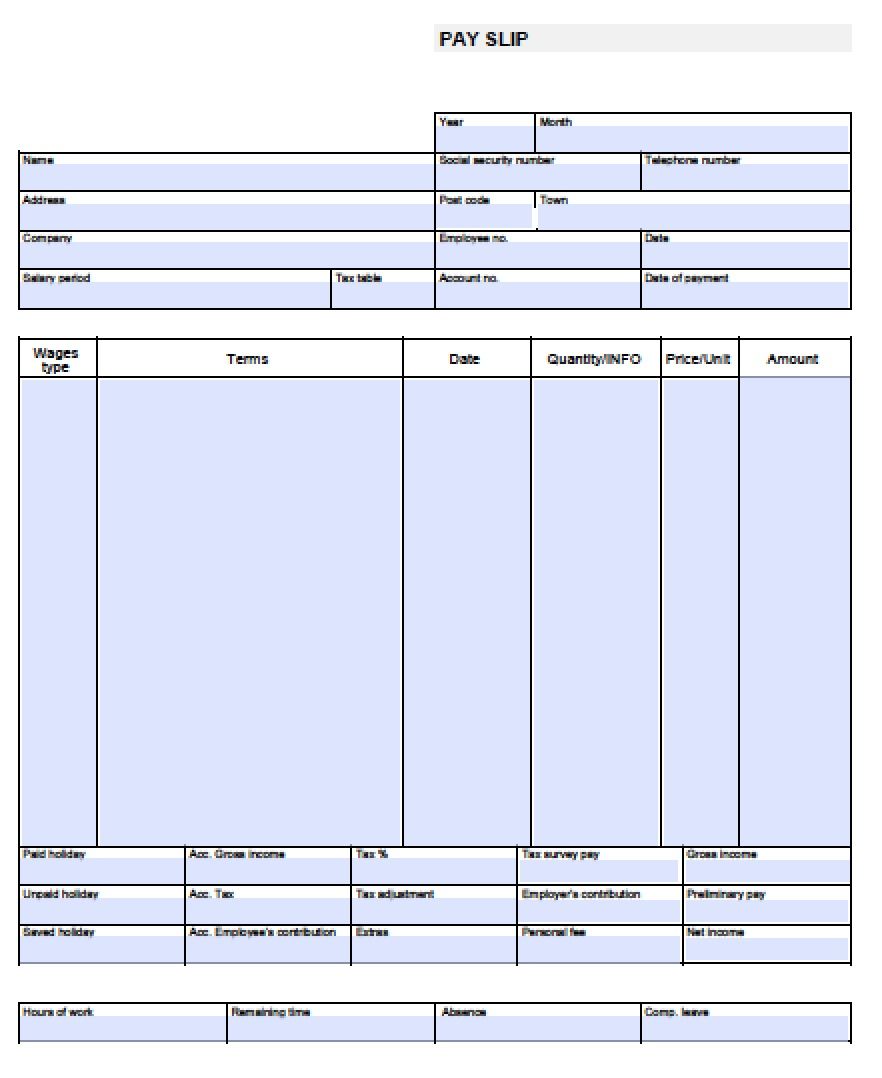

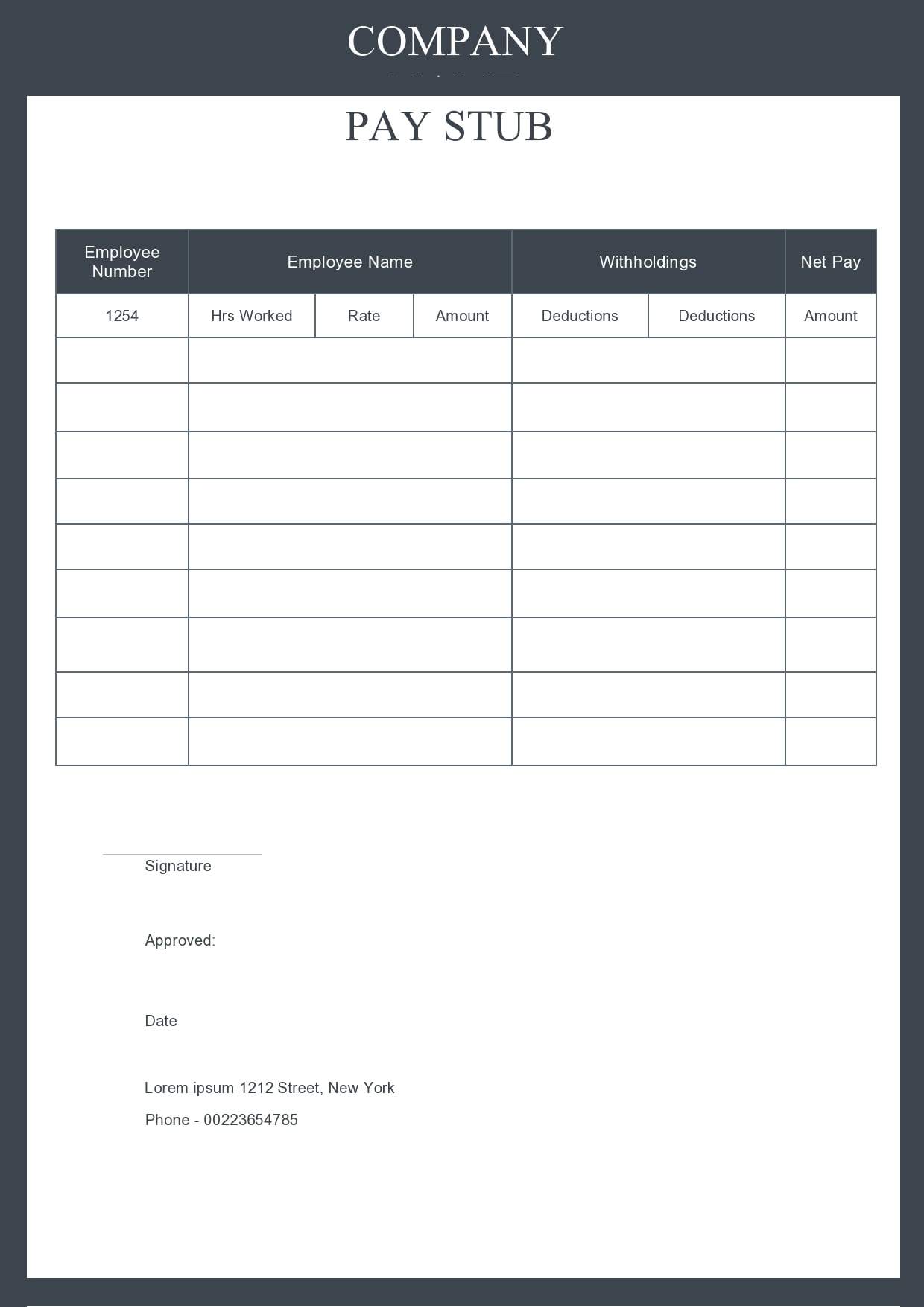

If you don’t receive a paper pay stub, you can always make your own using a spreadsheet program. There are many free templates available on the Internet. In order to make your own pay stubs, you must know your income, deductions, and net pay. You can also make your own stub template if you have Adobe Acrobat DC. Here are some tips on how to make a pay stub:

Firstly, make sure the paystub is accurate. Most major businesses will require you to check your paystubs before you get paid. There could be a discrepancy between your employer and the bank. By making your own pay stubs, you’ll know what to look for when verifying your own pay. This will ensure that you don’t make any mistakes or inadvertently miscalculated deductions.

What Do You Need To Know About Paycheck Stubs?

When choosing a template for your pay stubs, there are some important things to keep in mind. For example, you may want to avoid including an employee’s Social Security number on your pay stubs. Instead, choose the “Display Last Four Digits of Employee SSN on Check Stub” option. You should note that some states don’t allow employers to display the full SSN on pay stubs. Alternatively, you may want to use a different name on your stubs for tax purposes.

Pay stubs must also include the date on which the employee was paid and their pay rate. For hourly employees, you should also indicate the amount earned for each type of income. This includes regular wages, tips for tippable employees, and more. You should also include the total tax year-to-date and hourly rate. If you’re an employer, this is an essential piece of information for a pay stub.

Printable Blank Paycheck Stubs

A free pay stub maker is a convenient way to create the paperwork required by employees. These forms can be filled out online and contain the information of both the employer and employee. The tool will also allow users to add an electronic signature. Once completed, the stubs can be printed or saved and shared. The pay stubs are provided in PDF format. In the event of any errors, a user can contact the support team for assistance.

While creating pay stubs for your employees, you should take care to fill in as much information as possible. You don’t want careless mistakes to cause misunderstandings or audits. You should fill in the name of the company, address, license numbers, and the full legal name of each employee. You should also fill in the employee’s id number if you receive it via mail. You can even include a check number if you want to keep track of previous pay stubs.