If you are looking for a way to keep track of your checkbook, then you might want to consider getting a printable checkbook register. This will help you keep track of your money, and you’ll be able to take your register with you wherever you go.

Do Banks Give Free Checkbook Registers?

One of the best ways to stay on top of your finances is by maintaining a checkbook register. This is a convenient way to keep track of your checking account balance and credit card transactions. It can help you identify errors and fraudulent activity and prevent overspending.

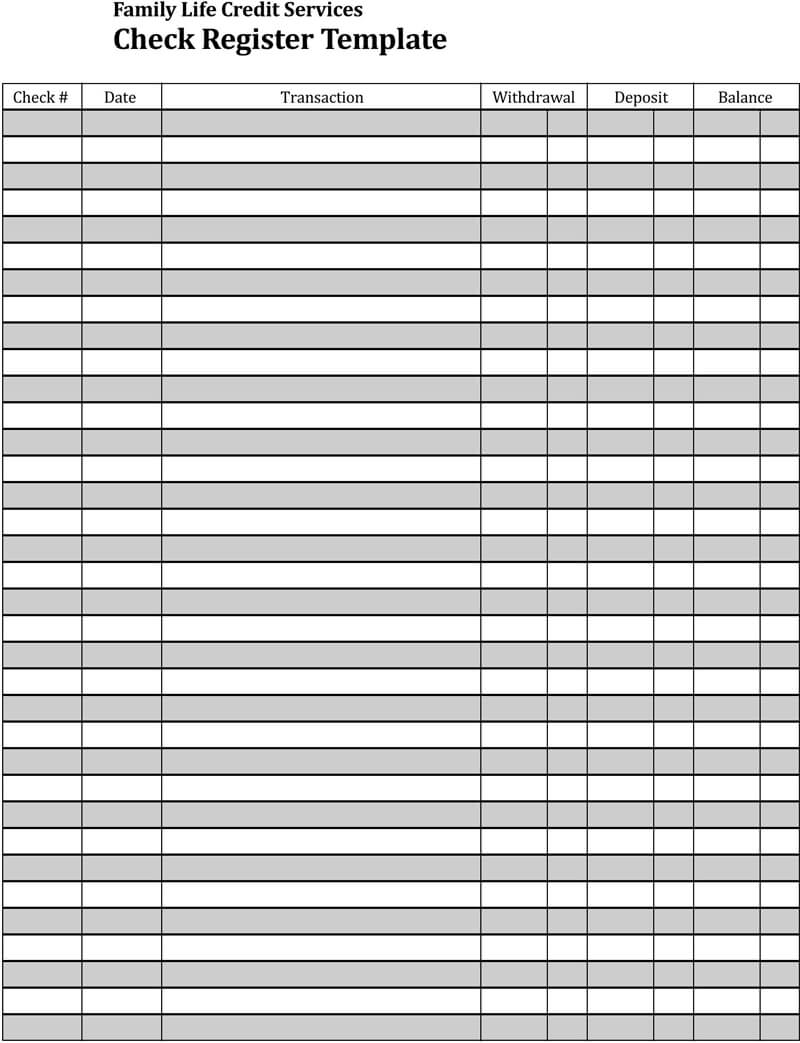

Check registers are available in both paper and electronic formats. Choosing a check register depends on your personal preference. Paper-based registers are easy to use and inexpensive. They are generally available through your local bank. Electronic registers are also available online. You can download free printable check register templates and print them out.

Your bank may provide you with a free checkbook register when you open a new checking account. However, this is not always the case. Sometimes, you will have to pay to obtain a registration.

The good news is that many banks offer free checkbook registers. However, it is important to maintain your registration in a timely manner. This is to ensure that your records reflect your true account balance.

Although your bank’s website and online banking services can help you track your financial activities, it is still a good idea to keep a paper register. Not only is it easier to manage your cash, but it is also less likely to get lost.

Can I Print My Own Check Register?

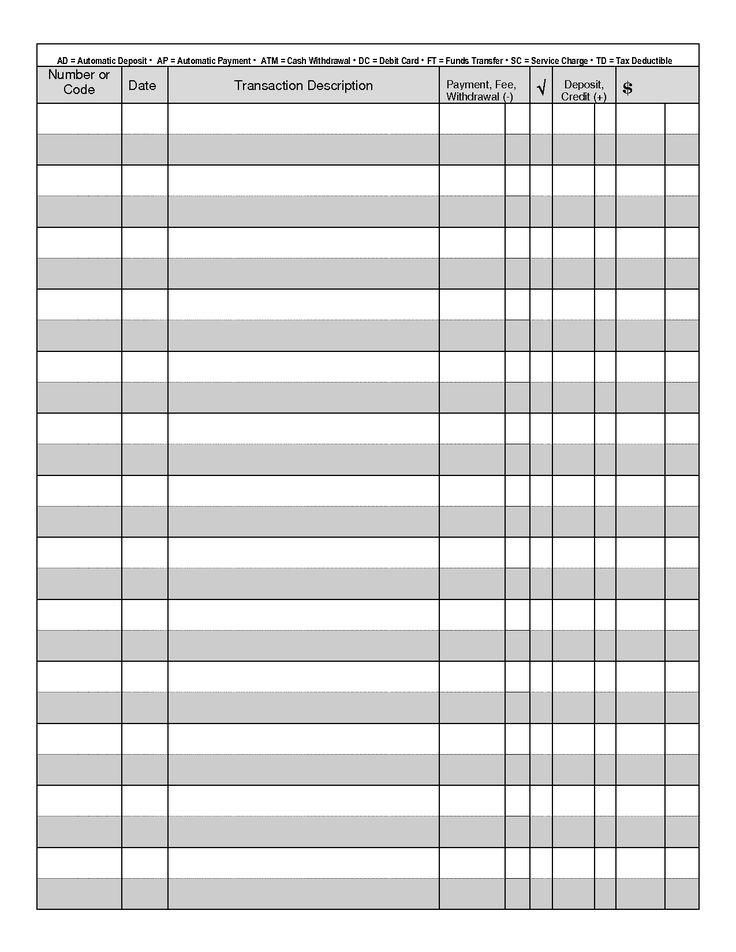

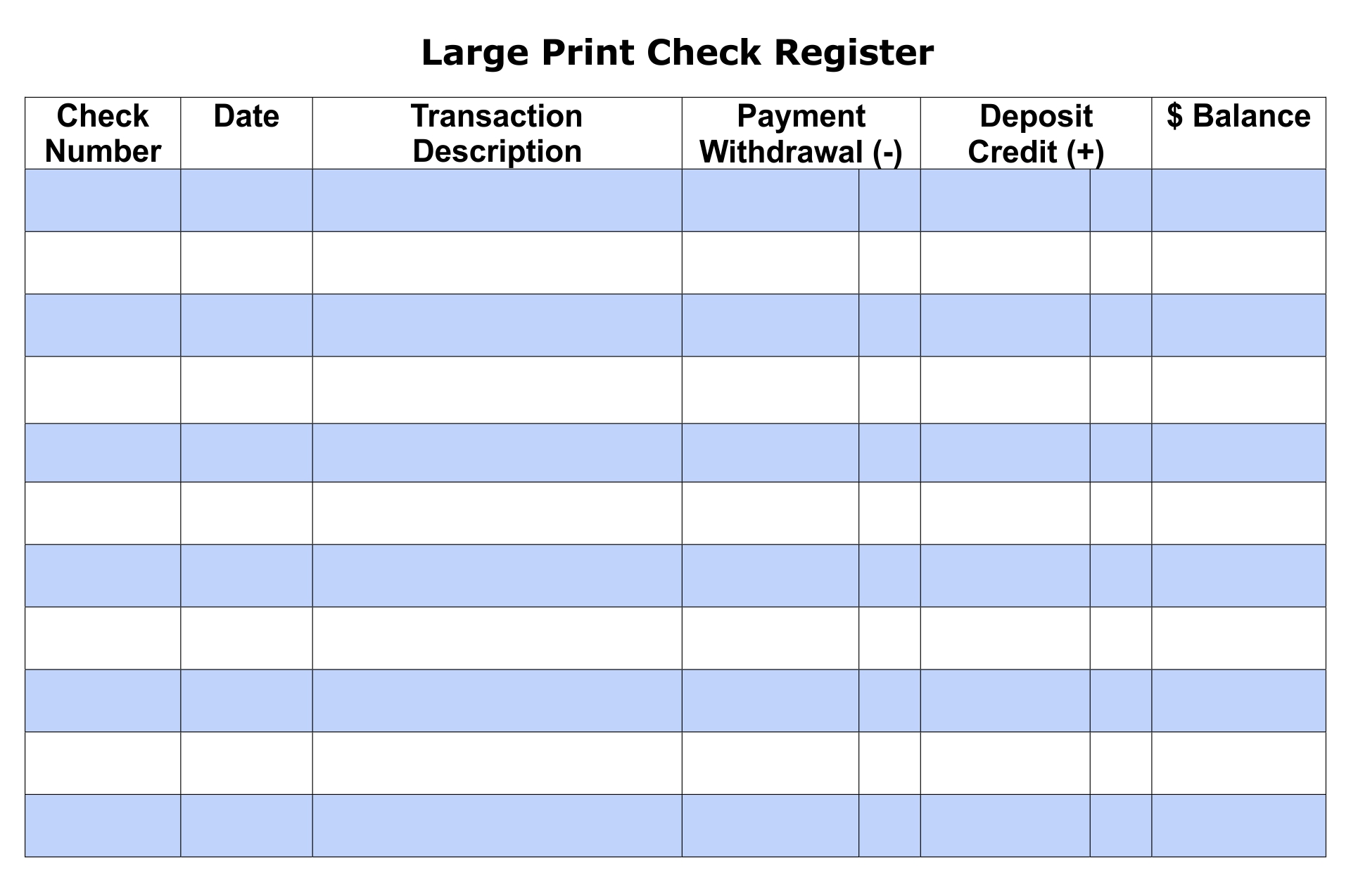

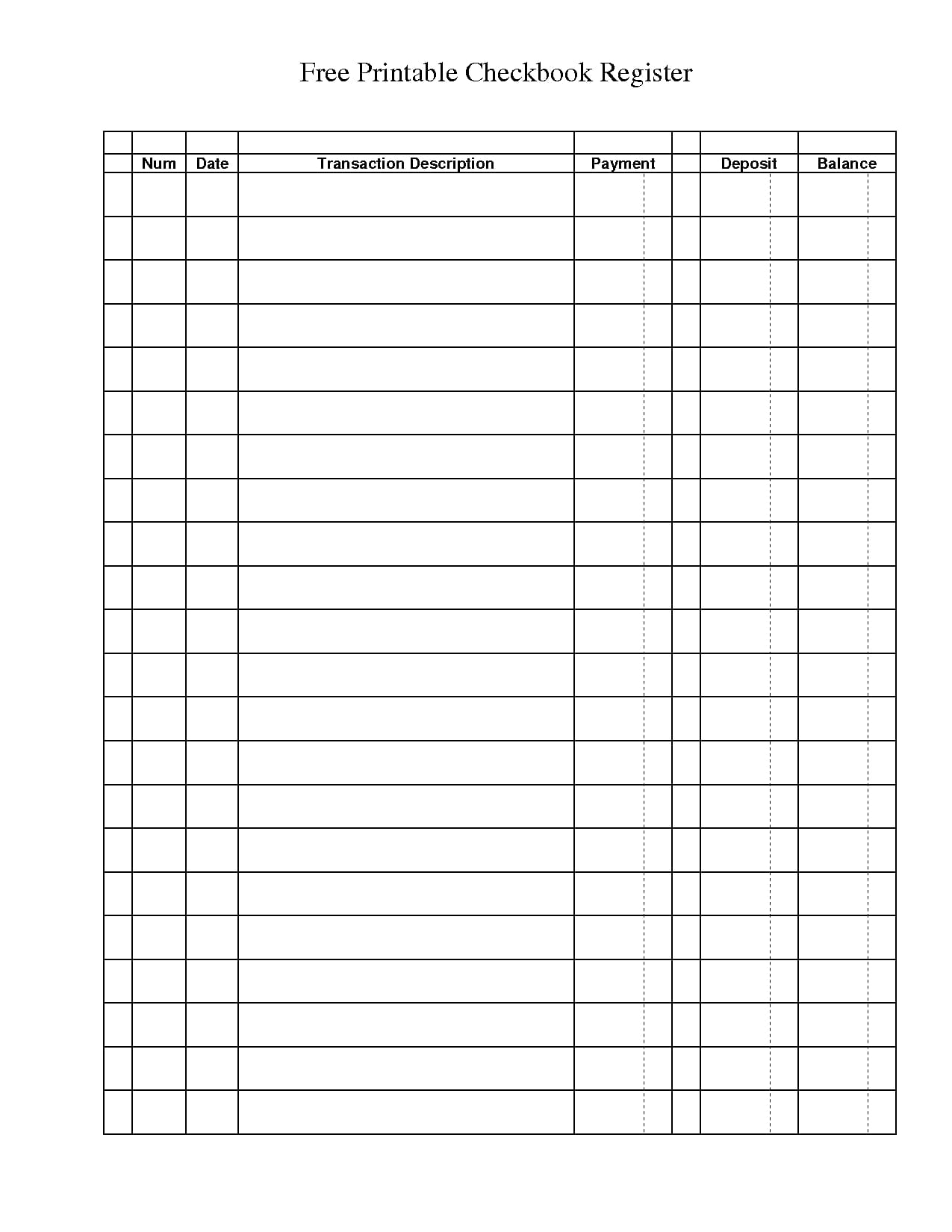

The check register is a record that traces all the financial transactions of a person. It helps to record debits and credits, payments, withdrawals, and other banking activities. A check register is usually printed and bound. But there are also free check register templates available online. These can be downloaded as PDF files and opened with an Adobe reader.

Using a printable check register can help you keep track of your banking activities. You can print a check register form on regular 8.5 x 11-inch letter-size paper. You can print your register in landscape mode for easy viewing. Once you have the form, you can fill it out in a soft copy or a hard copy.

Before you print your check register, you need to gather all the necessary documents. This includes the account number, transaction description, and the date of the transaction. Make sure you write the right information in the correct fields.

Another way to create a check register is by using a software application. One of the most popular software applications for checking accounts is Excel. However, it can be cumbersome to input transactions in a handwritten format. Fortunately, there are check register templates for Microsoft Excel and Google Sheets.

Check registers can be bought from a variety of retailers. They can be found online or in bookstores. Some even offer them as a service.

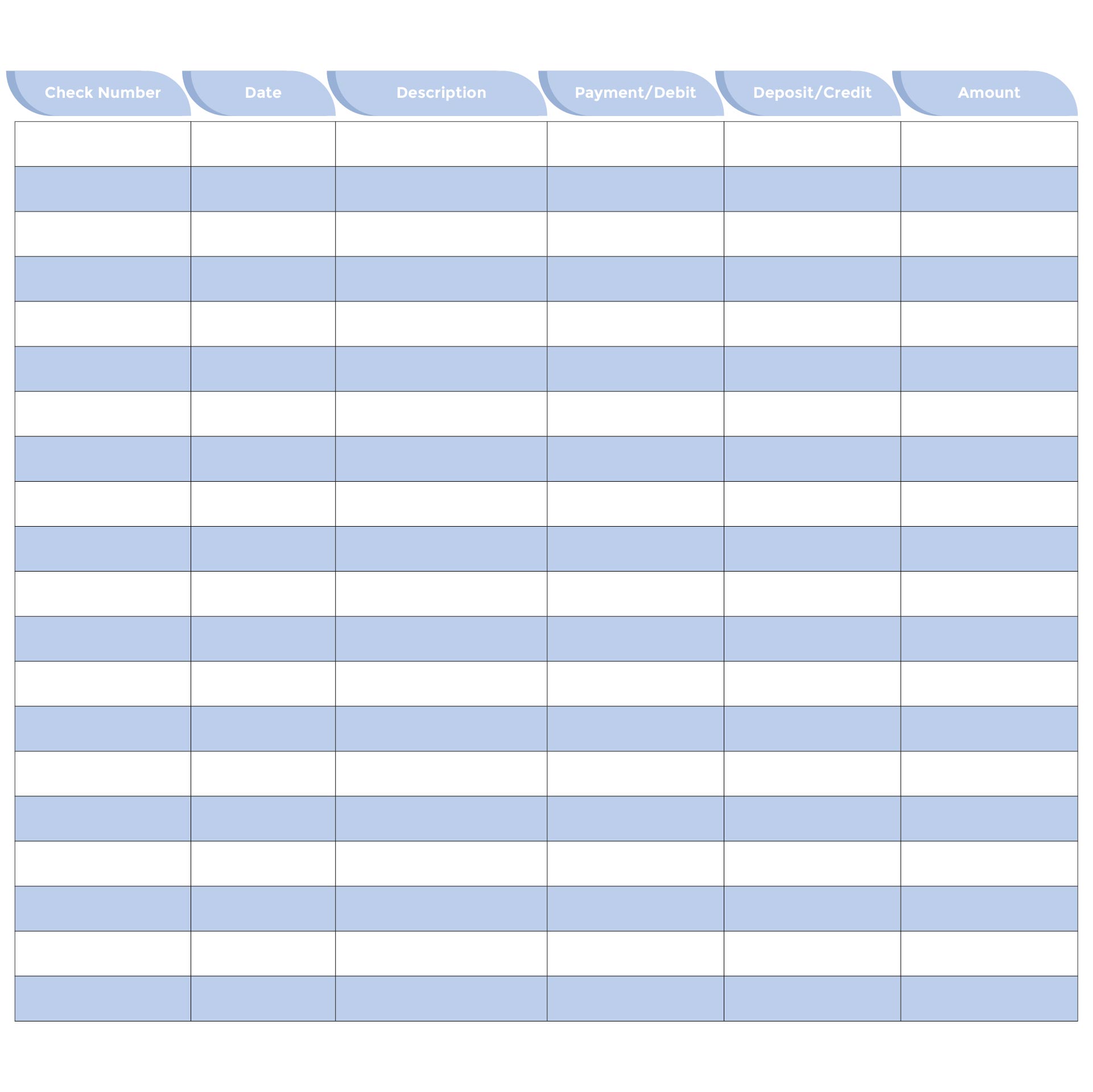

Printable Checkbook Register

When you use a checkbook, you have a record of your transactions. This helps you control your cash flow. You can also catch errors in your bank’s calculations. If you do not want to carry your checkbook around with you, you can download a printable checkbook register and keep track of your expenses.

Keeping a checkbook is useful for both banks and account holders. It allows you to monitor your expenses and minimize your expenses. You can use the printable checkbook to make sure you are not overspending in any category. You can also track your deposits and withdrawals.

In order to make the most out of a checkbook register, you need to fill it out correctly. It is a good idea to fill out the form from top to bottom. Start by listing the name of the transaction and the amount withdrawn or deposited. Then, include the date the transaction took place and the description of the transaction. Next, enter the balance. Finish by indicating the total balance.

There are two types of checkbook registers: soft copy and hard copy. Both can be downloaded in PDF format. However, a soft copy is easier to work with and it is compatible with most computers. A hard copy is usually printed on paper.