To understand your checking account, you must know the Ledger Balance. You can do this by keeping track of your business’ financial transactions. The revenue part of the balance sheet shows how much money your company makes, and you can increase this by increasing your assets and decreasing your liabilities. The expenses part shows how much you spend on the assets that generate the revenue. Business costs are included in expenses and include rent and utilities. In addition, the date is used to track any financial transactions.

How Do You Make a Ledger Balance Sheet?

The balance sheet is a comprehensive document that summarizes classified information in the business’s books and journals. It is also called the “second book of entry” and includes the accounts for assets, liabilities, owners’ equity, revenues, and expenses. All transactions posted to the accounts on either side of an equal sign must be equal to the total of those posts on the other side of the equal sign. This balancing rule can apply to equations that have different numbers of accounts.

To understand how to make a ledger balance sheet, you must first understand the concepts that make up a balance sheet. First of all, the term “revenue” refers to the amount of money received during a specified period. Specifically, a business earns operating revenue from its main business operations, while non-operating revenue comes from activities that are not directly related to the business. Then, the business incurs expenses to maintain its operations. In order to break down the general ledger entries into individual categories, the account names are called sub-accounts. These accounts are located under the main accounts, and allow you to further analyze the information contained in the columns.

What is the Ledger Balance in a Checking Account?

The ledger balance in a checking account refers to the available balance, which is the amount of cash available for withdrawals. This balance is the beginning balance of the previous business day, and it remains consistent throughout the day. The available balance, on the other hand, is the current balance of the account, less any temporary holds. A negative available balance in a checking account means you’re close to a deficit. To avoid this, it’s important to deposit funds before the end of the business day.

A ledger balance is calculated by adding up the opening and closing balances of the previous day, and then dividing that result by the number of days in a month. The opening balance represents the amount of money in the account, and the closing balance reflects all pending and posted financial transactions. The total of all credits and debits posted during the day will produce the ledger balance at the end of the day.

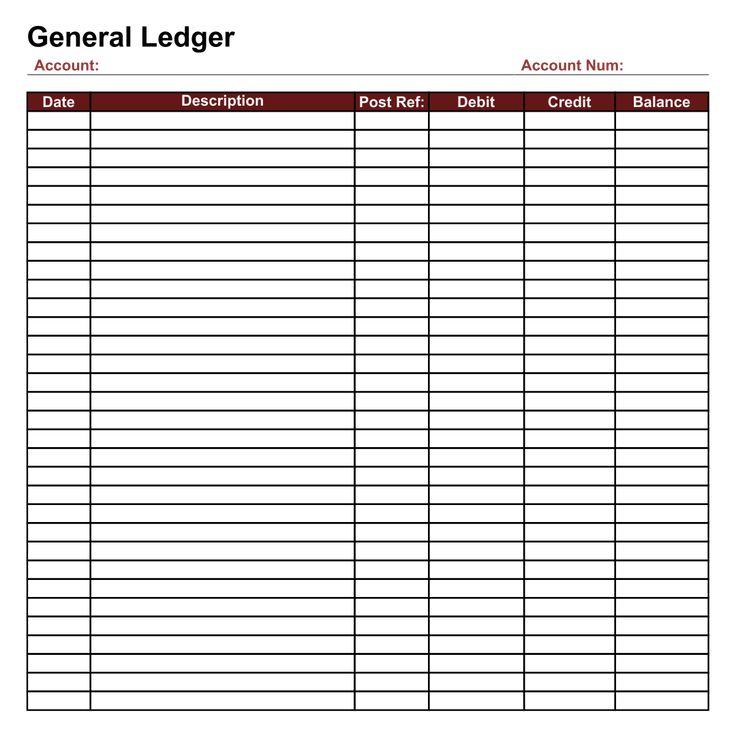

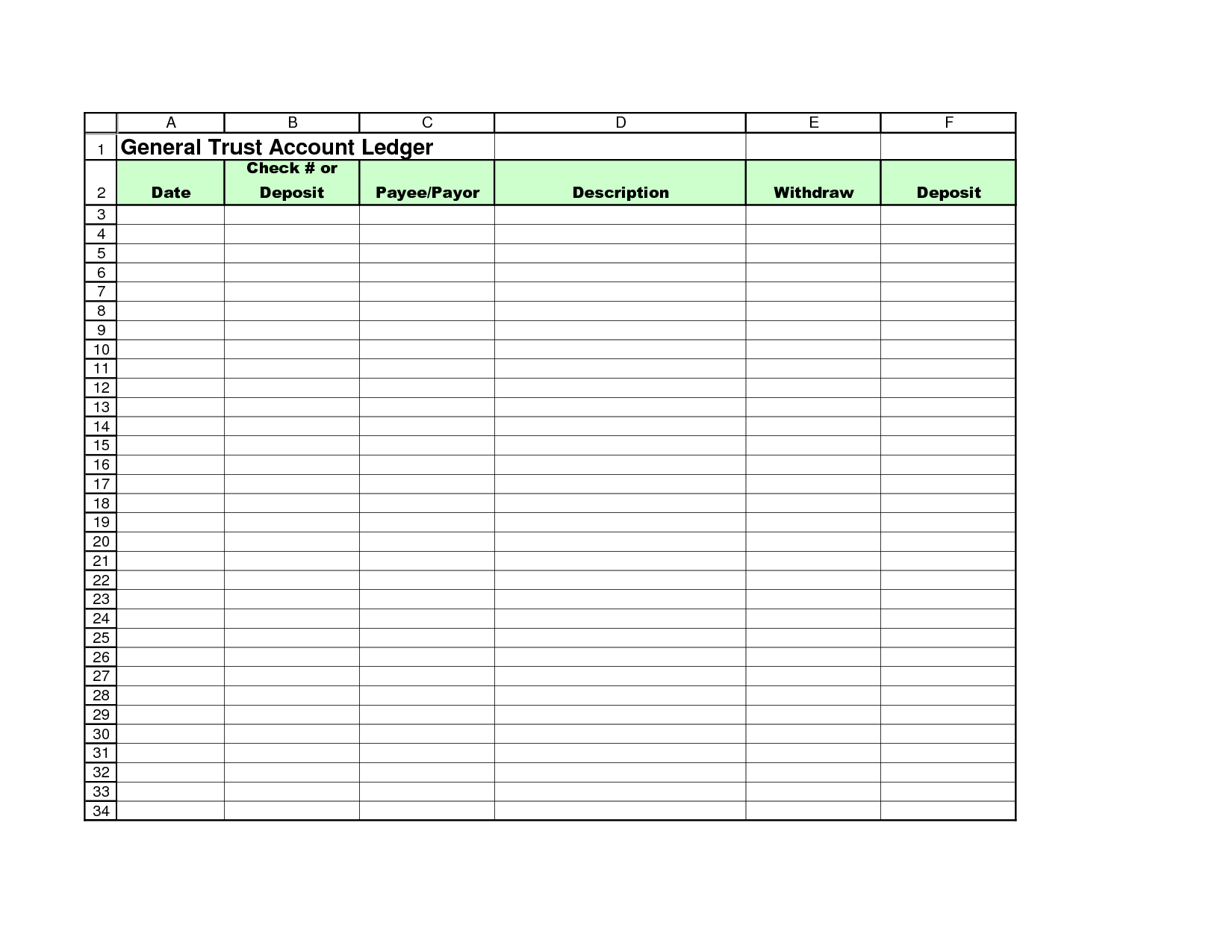

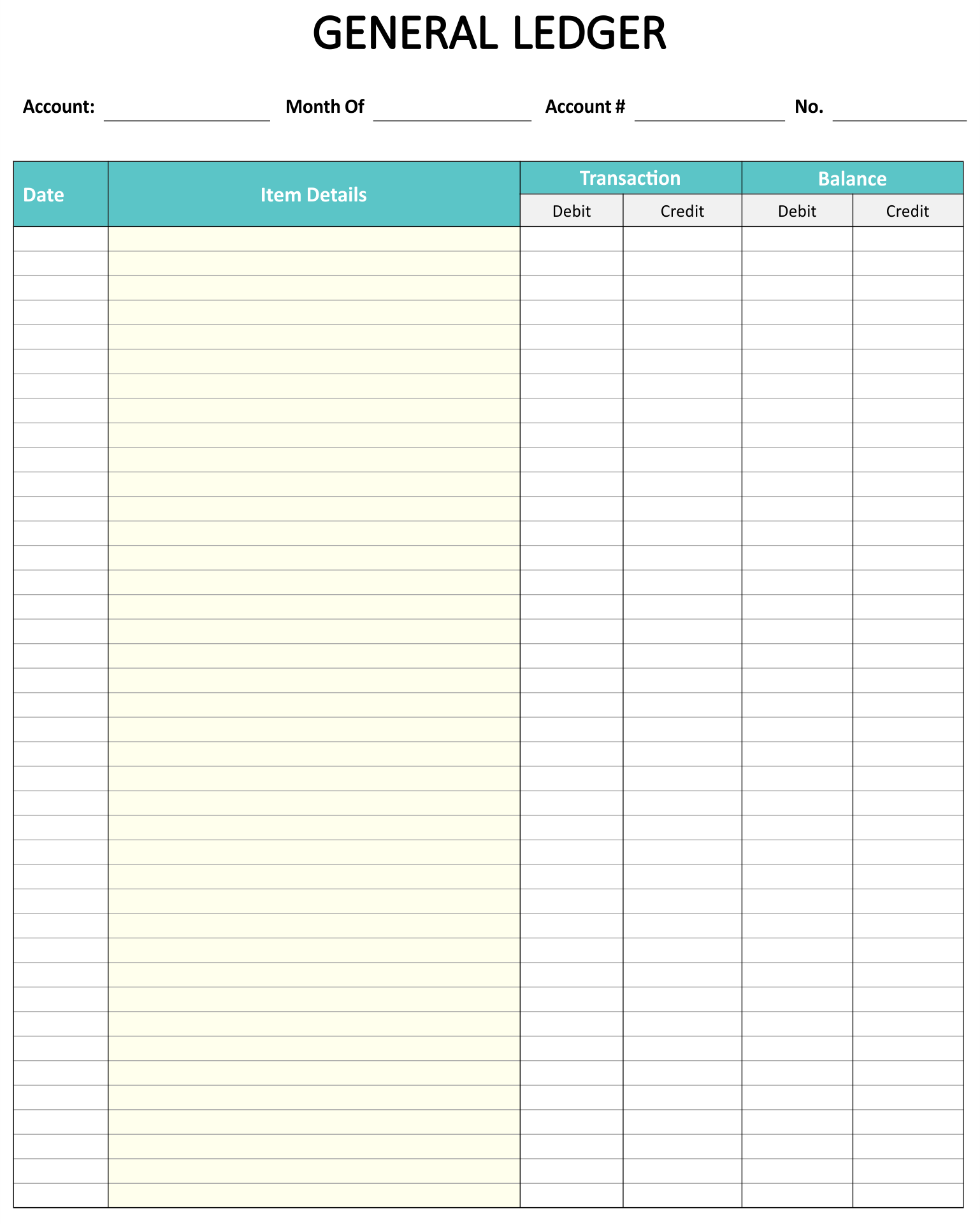

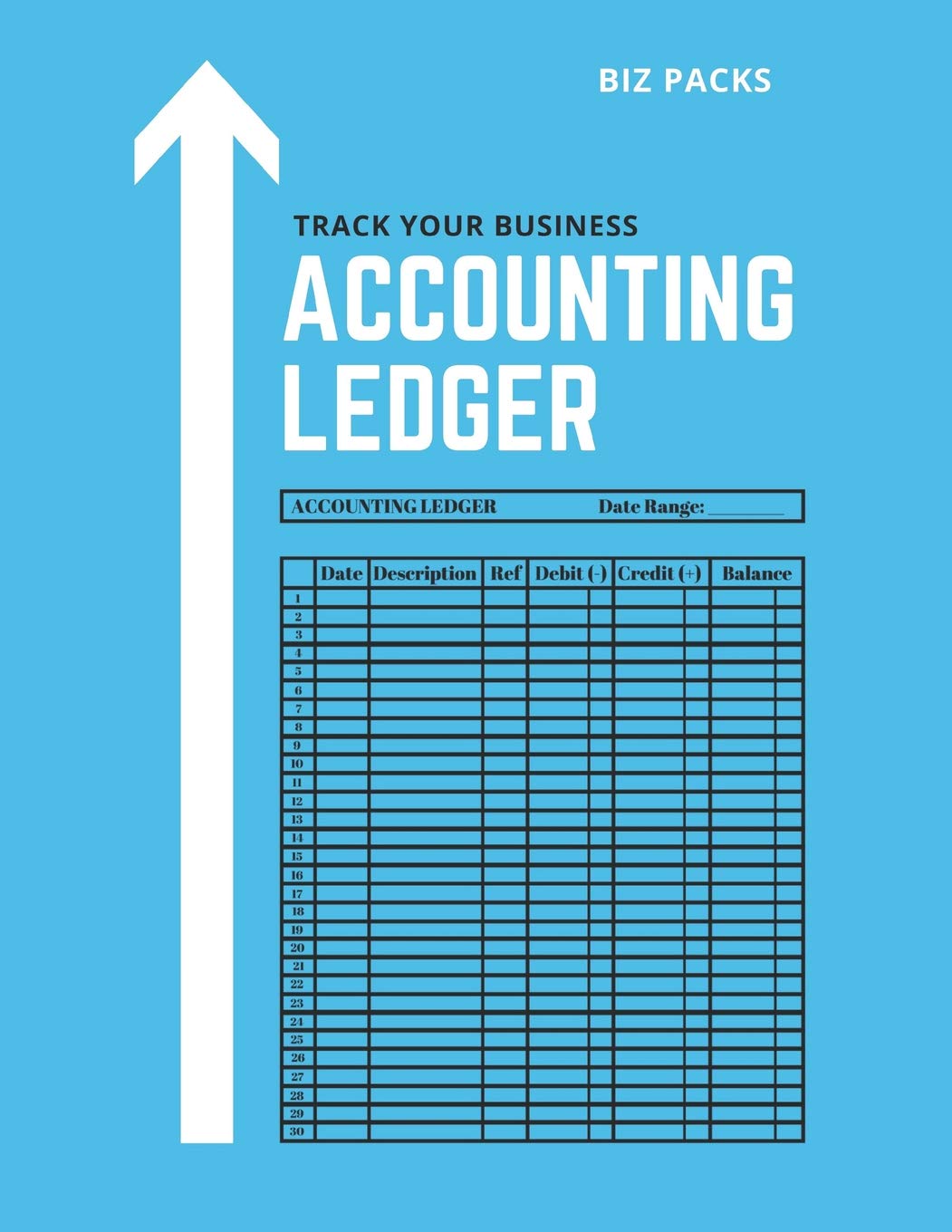

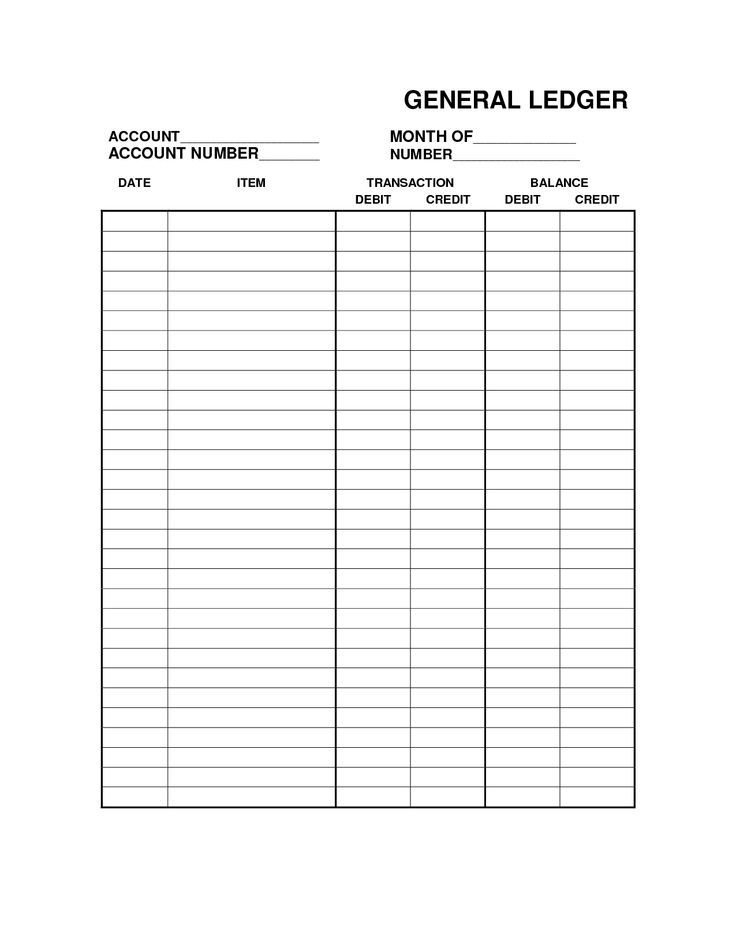

Printable Ledger Balance Sheet

A Printable Ledger Balance Sheet is a financial statement for a business. You will often encounter this document while dealing with a bank or a company. The general ledger balance sheet lists a company’s money management and transactions. This document requires preparation and organization. This guide will show you how to prepare a printable ledger balance sheet for your business. Read on to learn more. But first, let’s discuss what exactly it is.

A General Ledger is a spreadsheet that lists financial transactions in separate balance sheet accounts. It helps you keep track of your finances and spot any mistakes, and the printable Ledger Balance Sheet can be a good start. These templates include sample text and debit and credit figures, which will help you prepare an accurate financial report. This template will help you prepare your balance sheet by recording your business’s expenses and revenue. This is a vital document in accounting, and it is easy to use.